The Future of Work

The AI Agent Platform Built Only for Insurance

Unlock the future of insurance with the Roots’ platform. Leverage AI to streamline quoting, improve claims handling, and boost operational efficiency. Reduce leakage, optimize premiums, and deliver faster, more accurate service to policyholders—all while increasing profitability and gaining a competitive edge.

The Future of Work

The Future of Work

The AI Agent Platform Built Only for Insurance

Unlock the future of insurance with the Roots’ platform. Leverage AI to streamline quoting, improve claims handling, and boost operational efficiency. Reduce leakage, optimize premiums, and deliver faster, more accurate service to policyholders—all while increasing profitability and gaining a competitive edge.

Request a Demo

Top insurance companies trust Roots

Increase Satisfaction

Delight Your Policyholders

Provide outstanding service by processing claims faster and more accurately, offering quicker quotes, and ensuring your policyholders feel appreciated and satisfied. Stand out in a competitive market and increase customer loyalty.

ADD team Capacity

Transform Your Operations

Increase overall operational efficiency with advanced automation. Simplify processes, automate manual tasks, and cut down on mistakes. Free your team to focus on important tasks like reducing claims leakage and optimizing premium pricing based on access to more risk data. Add instant operational capacity to every team where you deploy AI agents.

Accelerate Expansion

Grow Your Business

Efficient quoting and precise claims data and handling are key to keeping healthy combined ratios. Quicker quote times lead to higher bind rates and more premium income. Reduce leakage to ensure correct payouts, protecting capital and increasing profitability. Implement operational changes to claims and underwriting activities to impact your performance and profitability, and help you thrive in a competitive market.

AI Platform

Meet our AI Agents

Struggling with operational bottlenecks and leakage? Roots provides claims and underwriting teams with AI Agents built with deep insurance expertise. Together, we'll accelerate your digital transformation, enhance operational excellence, and reimagine how you provide amazing customer experiences.

- Streamline Processes: Automate routine tasks to reduce manual errors and improve efficiency.

- Enhance Accuracy: Leverage AI to ensure precise claims processing and underwriting decisions.

- Boost Productivity: Free up your team to focus on strategic initiatives and customer engagement.

- Improve Customer Experience: Deliver faster, more personalized service to delight your policyholders.

Achieve time-to-quote goals by accelerating submissions intake across all sources with triage, data extraction, priority routing, and automated clearance processes.

- Monitors for new submissions

- Classifies and routes requests

- Extracts required data

- Populates underwriting and ratings systems

Learn more

LEARN MORE

Deliver loss history data access and insights to underwriters to generate faster and more accurate quotes.

- Analyzes exposure and loss history

- Extracts loss data

- Populates data in required systems

- Out of the Box support for most carriers

Learn more

LEARN MORE ABOUT AI AGENT

Accelerate underwriting with automated application data processing.

- Analyzes application details

- Extracts application data

- Populates data across systems

Learn more

LEARN MORE ABOUT AI AGENT

Rapid schedule analysis for employee benefits, statements of value (SOV), vehicles, and property schedules via automated extraction.

- Analyzes schedules and SOV details

- Extracts schedules and SOV data

- Populates schedules and SOV data across systems

Learn more

LEARN MORE ABOUT AI AGENT

Automate document classification, indexing, and routing for faster claims intake.

- Monitors for claims files

- Classifies claims documents

- Routes files to best team

- Identifies duplicate files

Learn more

LEARN MORE ABOUT AI AGENT

Automate claims operations to speed up and improve the accuracy of evaluations, reserve setting, settlements, and everyday claim activities, for increased efficiency and cost savings.

- Classifies and routes claims documents to the best team

- Extracts key claims data and populates systems

- Sets initial reserves

- Completes diary and claims files updates

Learn more

LEARN MORE ABOUT AI AGENT

Automate FNOL/FROI steps for speedier claims processing, proactive setup, and more efficient management.

- Identifies FNOL/ FROI requests

- Extracts key data

- Looks for existing claims

- Creates new claim file

Learn more

LEARN MORE ABOUT AI AGENT

Rapid legal demand request identification with triage, extraction and subrogation support.

- Identifies legal requests

- Extracts key legal data

- Alerts adjusters to time sensitive responses

Learn more

LEARN MORE ABOUT AI AGENT

Increase claims clarity with summaries customized by role.

- Analyzes claim records and activity notes

- Creates claims digest reports

- Customizes summaries by role

- Summarizes across multiple documents

Learn more

LEARN MORE ABOUT AI AGENT

Expedite and improve bill review operations for faster bill payment and processing.

- Identifies medical bills

- Analyzes multiple bill types

- Extracts key data points

- Validates provider information

Learn more

LEARN MORE ABOUT AI AGENT

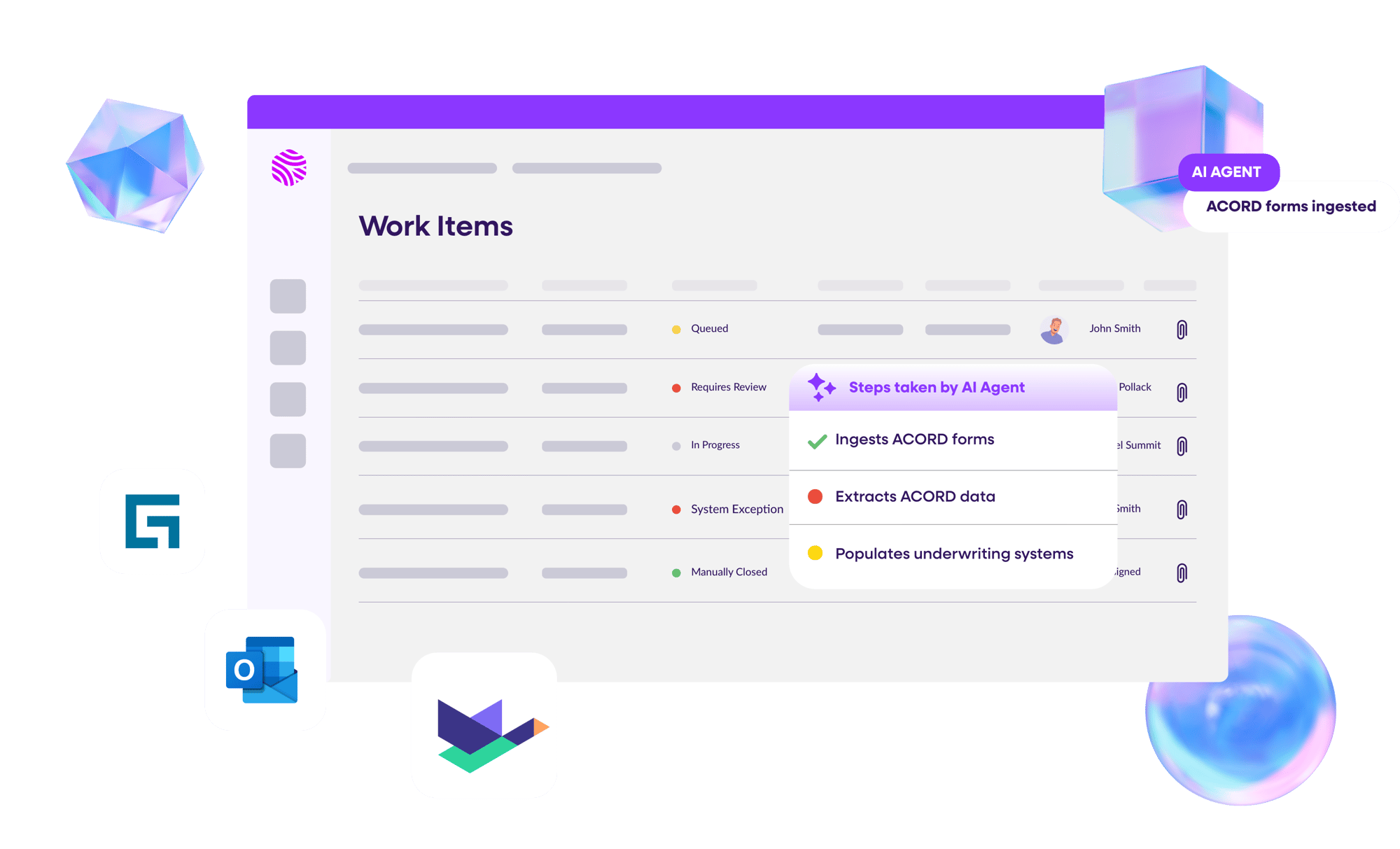

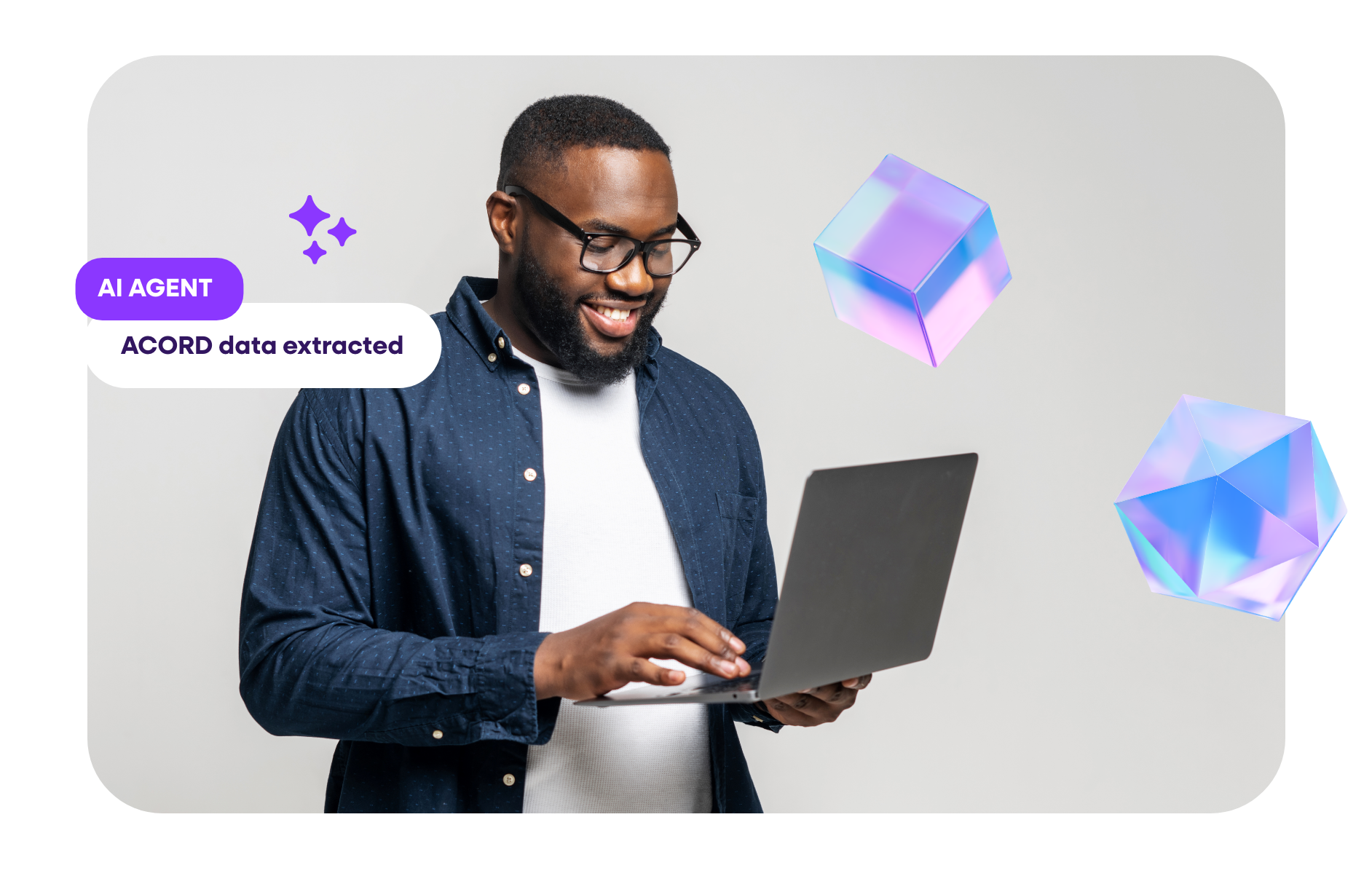

Automate ACORD forms to improve data availability and accuracy in underwriting and claims records.

- Analyzes ACORD form details

- Extracts ACORD form data

- Populates ACORD data across systems

Learn more

LEARN MORE ABOUT AI AGENT

- Renewal Monitoring

- Broker/insured outreach

- Extracts new renewal data

- Underwriter alerts

Learn more

LEARN MORE ABOUT AI AGENT

Efficient premium audits performed with 98%+ accuracy, automated data extraction, and system integration.

- Classifies audit documents

- Extracts audit data and populate systems

- Automatically requests missing data

Learn more

LEARN MORE ABOUT AI AGENT

24/7 COI creation automation that is fast, accurate, integrated, and reliable.

- Monitors for COI requests

- Extracts policy details

- Automates COI creation

Learn more

LEARN MORE ABOUT AI AGENT

Streamline email-based policy change requests with high accuracy and minimal manual effort.

- Monitors email for policy change requests

- Identifies Line of Business

- Extracts change request type and data

- Processes requests automatically

Learn more

LEARN MORE ABOUT AI AGENT

Faster payments processing with automated invoice data extraction and handling.

- Identifies invoices in emails and attachments

- Extracts payment details

- Processes payments through claim systems

Learn more

LEARN MORE ABOUT AI AGENTLatest Blog Posts

2026 will be a defining year for insurance tech transformation – you can see our predictions here. Your business – and more importantly,...

AI Platform

Discover the Roots Platform

The Roots Platform is designed to revolutionize the insurance industry with cutting-edge technology and deep industry expertise. Our comprehensive suite of tools and features empowers claims and underwriting teams to achieve operational excellence, enhance customer experiences, and drive business growth.

Customer Success Story

What customers are saying about Roots

TRUST CENTER

Building AI Responsibly

At Roots, our singular focus is supporting insurance companies in delivering on their customer promises while keeping the trust and security of our AI at the forefront of everything we do.

TRUST CENTER

Secure and Compliant

Roots meets ISO 27001, SOC 2 Type 2, HIPAA and CCPA compliance requirements.